Markets & Economy

The Federal Reserve announced on Wednesday that a reduction to its $120 billion per month asset purchase program “may soon be warranted,” so long as the economy continues making progress toward its goals of 2% inflation and full employment.

Although the Fed chose not to break any news on when it will begin tapering, we still expect the U.S. central bank to begin slowing the pace of its bond-buying program in the final months of the year.

As recently as last month, some investors believed that the Fed could announce the start of its taper as soon as its September meeting, but a relatively weak jobs report paired with a softer inflation reading in August closed the door on that possibility.

Now we expect the Fed to announce its intention to taper at its November meeting or later this year. That is, unless economic conditions deteriorate significantly before then.

Investment implications

While the immediate focus is on the Fed’s pullback from quantitative easing, we do not expect a repeat of the infamous Taper Tantrum of 2013, when yields soared as markets were caught off guard. The Fed’s clarity this time around has already led current bond yields to reflect the assumption of a taper announcement this year.

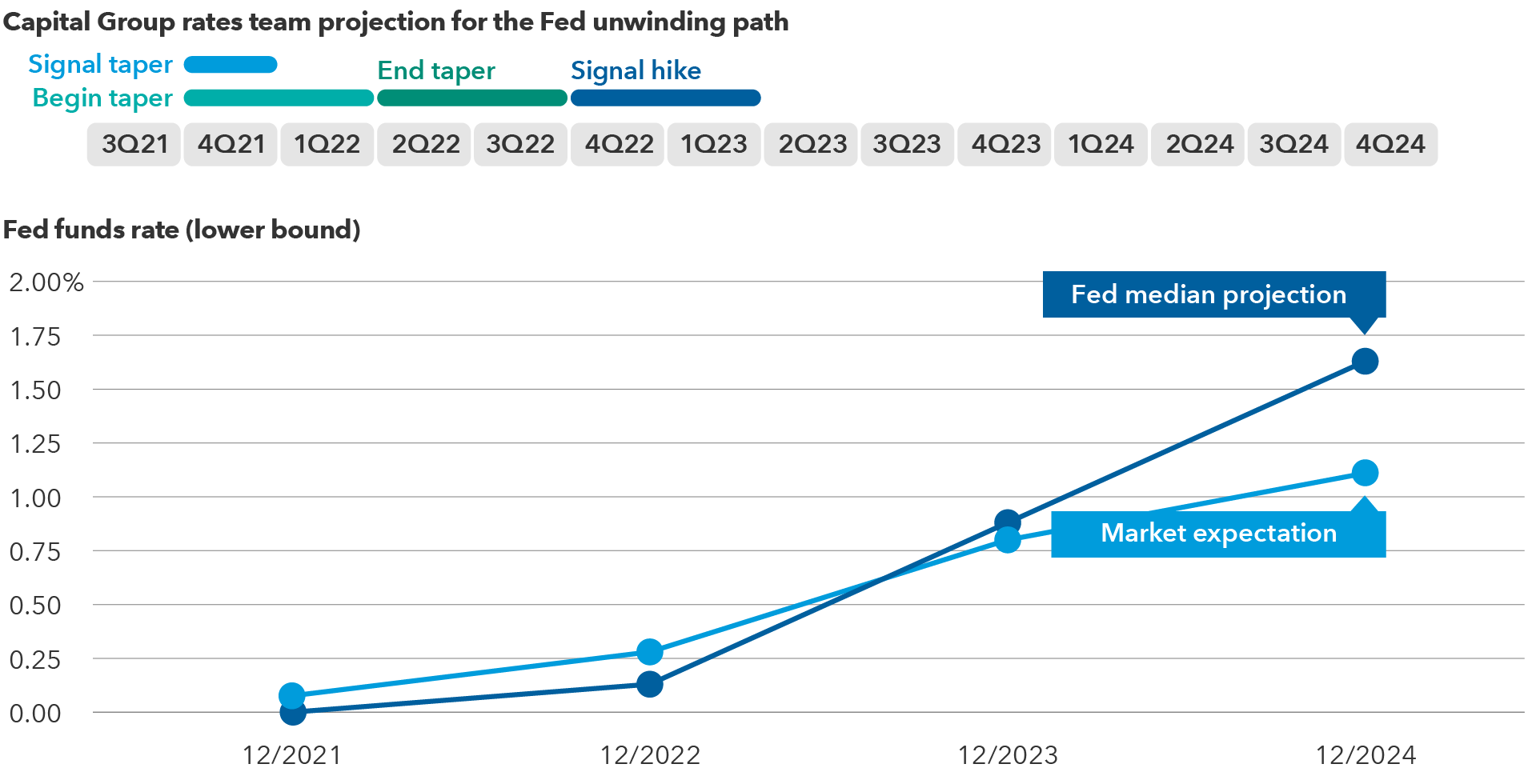

Based on the Fed’s previous statements and its prior tapering program, we expect this process to last roughly six to nine months, most likely ending around the middle of 2022.

Once tapering is underway, investors’ concern will likely shift to how quickly the Fed will start hiking interest rates. If inflationary pressures persist and the labor market trends in a positive direction, we could begin to see Treasury yields rise across the maturity spectrum.

Inflation

We continue to believe that inflationary pressures will be more persistent than Fed Chair Jerome Powell has said he expects them to be. No doubt, the August core CPI report came in below expectations, but price pressures are broadening. Ongoing supply chain issues, rising wages, loose monetary policy, low interest rates and higher inflation expectations all will likely play a role.

Also, the consumption rebound in the U.S. and Europe has continued despite the COVID-19 delta variant. Global manufacturing activity appears to be slowing, led by China. The delta variant also appears to be surging in parts of China, which could further exacerbate supply chain constraints. All these factors lead us to believe that inflationary pressures will not be transitory.

But we also know that the Fed is willing to see inflation overshoot its 2% target for a period if labor markets do not fully recover.

Unemployment

Full employment is tougher to measure. Payroll surveys show the U.S. had 5 million more people working in early 2020 compared to the summer of 2021. And that figure doesn’t account for natural growth averaging around 200,000 new workers each month. That widens the gap to around 8 million fewer workers than full employment would imply.

However, looking at wages and job opening numbers complicates this picture. Lower-wage workers have seen income gains exceeding 3% this year – well above average. We are also seeing 1.3 job openings for each unemployed worker, which would normally indicate a very strong labor market.

But the labor market could look less healthy next year than those job openings and wage increases indicate. The Fed could delay the first rate hike if employment needs more time to heal. If, on the other hand, inflation pressures begin to look more severe, the Fed may feel compelled to respond sooner.

Rate hikes

Our base case is that the Fed is not likely to begin considering raising rates until late 2022. Once it does allow short-term rates to move higher, we expect it to do so in a very gradual manner, as it did from 2015 through 2018.

The latest iteration of the Fed’s “dot plot” chart shows a majority of officials expect three rate hikes in 2023. This is a change from its last poll in June, when officials expected only two. Nine of the 18 members polled in September expect rate hikes to begin as early as next year.

When the Fed begins rate hike discussions in earnest, it should lead to front-end yields rising more than long-end yields and cause the curve to flatten.

The Fed's expected unwinding path: Sequential and gradual

Sources: Capital Group, Bloomberg, Federal Reserve. As of 9/22/2021.

Some investors may fret or become nervous about the Fed pulling back. Yet, policymakers have done so only when they’ve been confident the economy can sustain it. Ultimately, normalization should help ease the concerns about inflation that have cast a long shadow over markets this year. Importantly, once the Fed has pulled back from quantitative easing and, eventually, raised interest rates, it will be in a much stronger position to act when the next major economic challenge begins.

Against this backdrop, we are generally short duration relative to the index in most of the portfolios we manage, as we prepare for tightening financial conditions.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Our latest insights

-

-

Fixed Income

-

-

-

Interest Rates

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Tim Ng

Tim Ng

Tom Hollenberg

Tom Hollenberg